Top Essay Writers

Our top essay writers are handpicked for their degree qualification, talent and freelance know-how. Each one brings deep expertise in their chosen subjects and a solid track record in academic writing.

Simply fill out the order form with your paper’s instructions in a few easy steps. This quick process ensures you’ll be matched with an expert writer who

Can meet your papers' specific grading rubric needs. Find the best write my essay assistance for your assignments- Affordable, plagiarism-free, and on time!

Posted: May 22nd, 2022

ABBREVIATIONS AND ACRONYMS

We get a lot of “Can you do MLA or APA?”—and yes, we can! Our writers ace every style—APA, MLA, Turabian, you name it. Tell us your preference, and we’ll format it flawlessly.

ASEAN: Association of Southeast Asian Nations

F&B: Food & Beverage

GDP: Gross Domestic Product

IBM SPSS: IBM Statistical Package for the Social Science

Totally! They’re a legit resource for sample papers to guide your work. Use them to learn structure, boost skills, and ace your grades—ethical and within the rules.

IJV: International Join Venture

JV: Join Venture

MNE: Multi-National Enterprise

Starts at $10/page for undergrad, up to $21 for pro-level. Deadlines (3 hours to 14 days) and add-ons like VIP support adjust the cost. Discounts kick in at $500+—save more with big orders!

OECD: Organization for Economic Co-operation Development

RBV: Resource Based View

SIC: Standard Industrial Classification

SME: Small and Medium Enterprise

100%! We encrypt everything—your details stay secret. Papers are custom, original, and yours alone, so no one will ever know you used us.

Chinese food habits are currently experiencing rapid changes. The increased buying power of the consumers has led to the adoption of a new lifestyle which affects also their diet – both in quantity and quality. This trend affects consumption growth rates which become remarkably high for meat, dairy products, fish, oil, pasta, confectionery and convenience food. Such context, along with relatively recent global trade agreements has remarkably increased the interest of firms to enter this sector. Furthermore, the introduction of new distribution channels is deeply changing the purchasing system: hypermarkets, supermarkets, convenience stores, corner shops, and e-commerce are spreading in the country, granting a bigger and more diversified marketing platform for food enterprises. Given the considerable business opportunity existing in the Chinese market, an increasing number of entrepreneurs have entered the market. However, for many of them it still represents a challenge from many points of view. The continuously updating legal and food safety system, the different business culture approach, the policy framework as well as the changing dynamics of its economy, make it complicated for international businesses to be quickly successful in the Chinese market.

In such scenario, it emerges the necessity to face the so called phenomenon of the Liability of Newness. Thus, the objective of this study is to identify, through a quantitative analysis, the factors that have influenced the performance of enterprises operating in this sectors.

From the analysis it results that the firm’s size, the experience of the firm in the Chinese market are significantly correlated to its performance, with a positive effect. On the other hand, ….

KEY WORDS:

Nope—all human, all the time. Our writers are pros with real degrees, crafting unique papers with expertise AI can’t replicate, checked for originality.

TABLE OF CONTENTS

Dedication

Claims of Originality

Claims of Thesis Authorization

Our writers are degree-holding pros who tackle any topic with skill. We ensure quality with top tools and offer revisions—perfect papers, even under pressure.

ABSTRACT

LIST OF TABLES

LIST OF FIGURES

1. CHAPTER 1 _ INTRODUCTION………………………………………….

Experts with degrees—many rocking Master’s or higher—who’ve crushed our rigorous tests in their fields and academic writing. They’re student-savvy pros, ready to nail your essay with precision, blending teamwork with you to match your vision perfectly. Whether it’s a tricky topic or a tight deadline, they’ve got the skills to make it shine.

1.1 Background of the study

1.2 Objective of the study

1.3 Motivation of the study

1.4 Structure of the dissertation

Guaranteed—100%! We write every piece from scratch—no AI, no copying—just fresh, well-researched work with proper citations, crafted by real experts. You can grab a plagiarism report to see it’s 95%+ original, giving you total peace of mind it’s one-of-a-kind and ready to impress.

Chapter 2 _ Literature review

2.1 Data collection and methodology

2.2 Measures of firm performances

2.3 Determinants of firm performance……………………………………….

Yep—APA, Chicago, Harvard, MLA, Turabian, you name it! Our writers customize every detail to fit your assignment’s needs, ensuring it meets academic standards down to the last footnote or bibliography entry. They’re pros at making your paper look sharp and compliant, no matter the style guide.

2.4 Research question

Chapter 3 _ THE CHINESE FOOD SECTOR

3.1 Economic background

3.2 Grocery Retailers and Food Service

For sure—you’re not locked in! Chat with your writer anytime through our handy system to update instructions, tweak the focus, or toss in new specifics, and they’ll adjust on the fly, even if they’re mid-draft. It’s all about keeping your paper exactly how you want it, hassle-free.

3.3 Market Overview

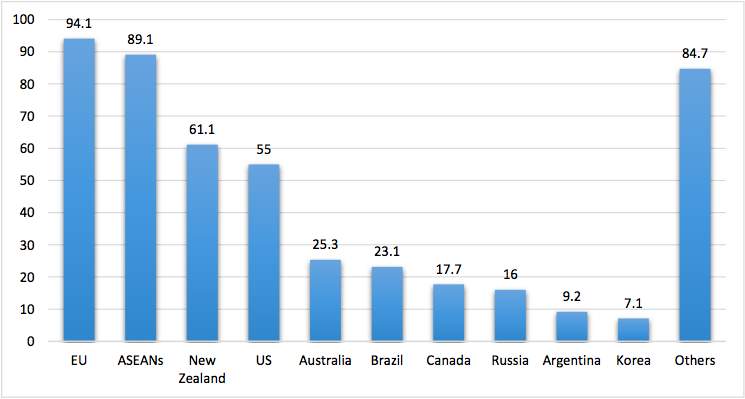

3.4 Demand for EU F&B in China

3.7 Opportunities for European firms: Niche Market……………………………..

Chapter 4 _ THEORETICAL FRAMEWORK

It’s a breeze—submit your order online with a few clicks, then track progress with drafts as your writer brings it to life. Once it’s ready, download it from your account, review it, and release payment only when you’re totally satisfied—easy, affordable help whenever you need it. Plus, you can reach out to support 24/7 if you’ve got questions along the way!

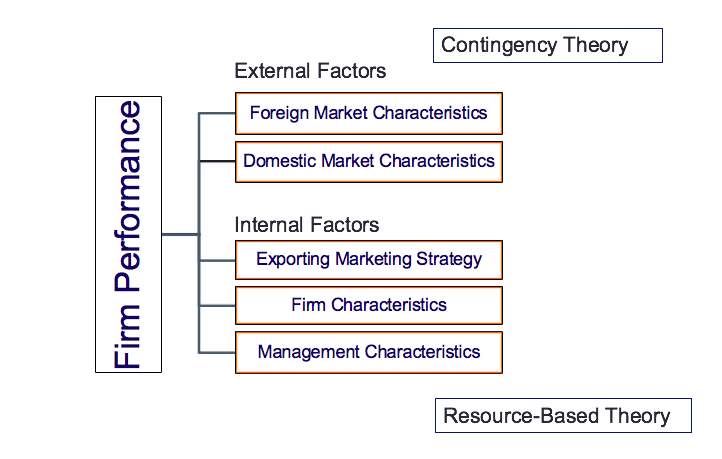

4.1 Resource Based Theory

4.2 The contingency paradigm

4.3 Hypothesis

Chapter 5 _ EMPIRICAL MODELS AND RESULTS

Need it fast? We can whip up a top-quality paper in 24 hours—fully researched and polished, no corners cut. Just pick your deadline when you order, and we’ll hustle to make it happen, even for those nail-biting, last-minute turnarounds you didn’t see coming.

5.1 Econometric Model Specification

5.2 Data

5.3 Model Parameters

5.3 Estimation results

5.4 Discussion

Absolutely—bring it on! Our writers, many with advanced degrees like Master’s or PhDs, thrive on challenges and dive deep into any subject, from obscure history to cutting-edge science. They’ll craft a standout paper with thorough research and clear writing, tailored to wow your professor.

Chapter 6 _ SUMMARY LIMITATION AND RECCOmmeNDATIONS

6.1 Summary

6.2 Limitation of the study

6.3 Recommendations

Bibliography………………………………………………………..

We follow your rubric to a T—structure, evidence, tone. Editors refine it, ensuring it’s polished and ready to impress your prof.

Send us your draft and goals—our editors enhance clarity, fix errors, and keep your style. You’ll get a pro-level paper fast.

Yep! We’ll suggest ideas tailored to your field—engaging and manageable. Pick one, and we’ll build it into a killer paper.

Yes! Need a quick fix? Our editors can polish your paper in hours—perfect for tight deadlines and top grades.

Table 1. Overview of the most commonly cited literature on the topic of website usability and user’s interaction.

Sure! We’ll sketch an outline for your approval first, ensuring the paper’s direction is spot-on before we write.

Figure 1.1 Thesis Structure……………………………………………..

Figure 0‑1…………………………………………………..

Definitely! Our writers can include data analysis or visuals—charts, graphs—making your paper sharp and evidence-rich.

We’ve got it—each section delivered on time, cohesive and high-quality. We’ll manage the whole journey for you.

Yes! UK, US, or Aussie standards—we’ll tailor your paper to fit your school’s norms perfectly.

If your assignment needs a writer with some niche know-how, we call it complex. For these, we tap into our pool of narrow-field specialists, who charge a bit more than our standard writers. That means we might add up to 20% to your original order price. Subjects like finance, architecture, engineering, IT, chemistry, physics, and a few others fall into this bucket—you’ll see a little note about it under the discipline field when you’re filling out the form. If you pick “Other” as your discipline, our support team will take a look too. If they think it’s tricky, that same 20% bump might apply. We’ll keep you in the loop either way!

2.1 Data collection and methodology

2.2 Measures of firms’ performances

2.3 Determinants of firm

2.4 Research question

Our writers come from all corners of the globe, and we’re picky about who we bring on board. They’ve passed tough tests in English and their subject areas, and we’ve checked their IDs to confirm they’ve got a master’s or PhD. Plus, we run training sessions on formatting and academic writing to keep their skills sharp. You’ll get to chat with your writer through a handy messenger on your personal order page. We’ll shoot you an email when new messages pop up, but it’s a good idea to swing by your page now and then so you don’t miss anything important from them.

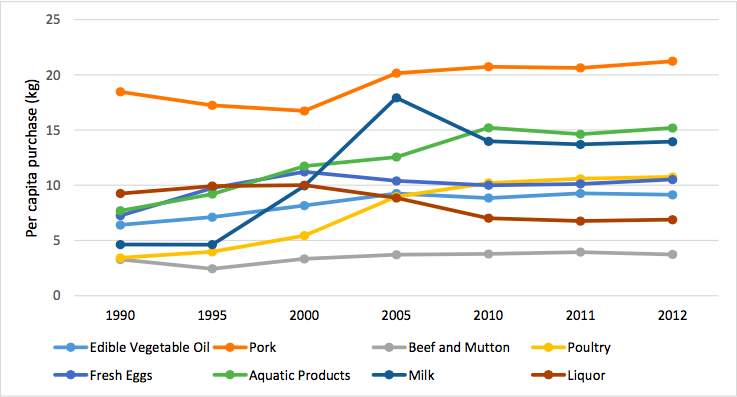

Figure 5.1 Per Capita Major Food Consumption Urban Household

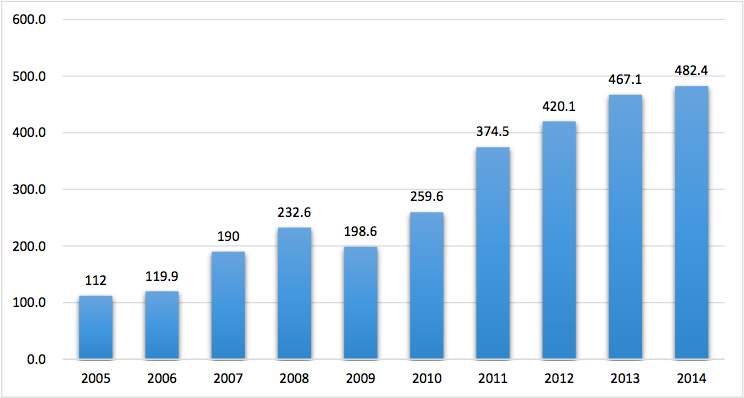

Figure 5.2 China’s Imported Food Trade Value 2005-2014 (in USD 100 million)

Figure 5.2 China’s Imported Food Trade Value 2005-2014 (in USD 100 million)

Figure 3.3 China’s Imported Food Trade Value 2005-2014 (in USD 100 million)

Figure 4.1 Theoretical Framework

Table 4.1 Hypothesis

| Hypothesis | Literature |

You Want The Best Grades and That’s What We Deliver

Our top essay writers are handpicked for their degree qualification, talent and freelance know-how. Each one brings deep expertise in their chosen subjects and a solid track record in academic writing.

We offer the lowest possible pricing for each research paper while still providing the best writers;no compromise on quality. Our costs are fair and reasonable to college students compared to other custom writing services.

You’ll never get a paper from us with plagiarism or that robotic AI feel. We carefully research, write, cite and check every final draft before sending it your way.