Top Essay Writers

Our top essay writers are handpicked for their degree qualification, talent and freelance know-how. Each one brings deep expertise in their chosen subjects and a solid track record in academic writing.

Simply fill out the order form with your paper’s instructions in a few easy steps. This quick process ensures you’ll be matched with an expert writer who

Can meet your papers' specific grading rubric needs. Find the best write my essay assistance for your assignments- Affordable, plagiarism-free, and on time!

Posted: March 10th, 2023

Topic: Does financial development stimulate firms’ investment financing? A study in Vietnam

Chapter 1: Introduction

Students often ask, “Can you write my essay in APA or MLA?”—and the answer’s a big yes! Our writers are experts in every style imaginable: APA, MLA, Chicago, Harvard, you name it. Just tell us what you need, and we’ll deliver a perfectly formatted paper that matches your requirements, hassle-free.

Chapter 2: Literature review

2.1 Sources of firms’ financing

For the purpose of this paper, investment refers to capital expenditure (Capex), which is measured by spending on plant, property and equipment. Basically, firm’s investment is financed by using two sources of finance: internal finance and external finance. Internal finance, i.e. self-financing, may consist of four main components: past profits which are not distributed to shareholders; additional capital from the owners; depreciation and amortization. Besides taking the advantages from itself when collecting internal sources for investment, firm might also use external source from loans of banks and other financial institutions or issue of new equity. This section is divided into two subsections: the former covers internal financing and the later external financing.

2.1.1 External financing

Absolutely, it’s 100% legal! Our service provides sample essays and papers to guide your own work—think of it as a study tool. Used responsibly, it’s a legit way to improve your skills, understand tough topics, and boost your grades, all while staying within academic rules.

2.1.2 Internal financing

There is a vast literature documenting the state that the greatest source of investment financing comes from internal sources. According to Sweezy (1968), the firm’s profits growth mainly contributes to the capital accumulation gain for the purpose of production expansion. Moreover, Mayer (1990) used US firms’ data from 1970-1985 to provide an empirical evidence that in this case, firms mostly rely upon internal sources. The result is similar to the study of British firms of chemical and electrical engineering industries from 1949-1984 that bank loans and bond securities do not play a significant role to fixed investment financing (see Table 1 ). However, he also argued that bank loans which are considered as the main source of external finance mostly contribute to firms’ working capital.

|

Table 1 : The proportion of financing sources in Two Industries in the UK How Much Does It Cost to Get a Paper Written?Our pricing starts at $10 per page for undergrad work, $16 for bachelor-level, and $21 for advanced stuff. Urgency and extras like top writers or plagiarism reports tweak the cost—deadlines range from 14 days to 3 hours. Order early for the best rates, and enjoy discounts on big orders: 5% off over $500, 10% over $1,000! |

|||

|

All samples |

Chemicals and allied industries |

Electrical Engineering |

|

|

Retentions Will My Use of This Service Stay Private?Yes, totally! We lock down your info with top-notch encryption—your school, friends, no one will know. Every paper’s custom-made to blend with your style, and we check it for originality, so it’s all yours, all discreet. |

91.0 |

89.7 |

117.3 |

|

Trade Credit Do You Use AI to Write Papers?No way—our papers are 100% human-crafted. Our writers are real pros with degrees, bringing creativity and expertise AI can’t match. Every piece is original, checked for plagiarism, and tailored to your needs by a skilled human, not a machine. |

1.5 |

-2.2 |

-11.9 |

|

Bank credit Why Choose You for Research Papers?We’re the best because our writers are degree-holding experts—Bachelor’s to Ph.D.—who nail any topic. We obsess over quality, using tools to ensure perfection, and offer free revisions to guarantee you’re thrilled with the result, even on tight deadlines. |

2.7 |

-2.2 |

-20.4 |

|

Long-term liabilities and issues of shares Who’s Writing My College Essays?Our writers are top-tier—university grads, many with Master’s degrees, who’ve passed tough tests to join us. They’re ready for any essay, working with you to hit your deadlines and grading standards with ease and professionalism. |

4.8 |

14.7 |

15.0 |

|

Total Are Your Papers Original?Always! We start from scratch—no copying, no AI—just pure, human-written work with solid research and citations. You can even get a plagiarism report to confirm it’s 95%+ unique, ready for worry-free submission. |

100.0 |

100.0 |

100.0 |

|

Note: The total sample refers to the period 1949-84; chemicals and allied and electrical engineering industries relate to the period 1949-82. Can You Match Any Citation Style?You bet! From APA to IEEE, our writers nail every style with precision. Give us your guidelines, and we’ll craft a paper that fits your academic standards perfectly, no sweat. Source: Goudie and Meeks (1986) in Mayer (1990) |

Using the same data of two industries in UK but with the different approach, Mayer (1990) examined the variation of capital structure according to the firm size. Table 2 points out that large firms seem to require more on internal financing in comparison with external financing.

|

Table 2: The proportion of financing sources according to three different firm size: Large and SMEs |

||||

|

Retention Can I Update Instructions Mid-Order?Yep! Use our chat feature to tweak instructions or add details anytime—even after your writer’s started. They’ll adjust on the fly to keep your essay on point. |

Banks, Short-term loans and trade creditors |

Issues of Shares and Long-term Debt |

Other sources |

|

|

All companies How Do I Get an Essay Written?Easy—place your order online, and your writer dives in. Check drafts or updates as you go, then download the final paper from your account. Pay only when you’re happy—simple and affordable! |

||||

|

Large |

70.9 |

23.2 |

5.7 How Fast Can You Handle Urgent Deadlines?Super fast! Our writers can deliver a quality essay in 24 hours if you’re in a pinch. Pick your deadline—standard is 10 days, but we’ll hustle for rush jobs without skimping. |

.2 |

|

Medium and Small |

52.6 |

45.7 |

1.3 Can You Tackle Complex Essay Topics?Definitely! From astrophysics to literary theory, our advanced-degree writers thrive on tough topics. They’ll research deeply and deliver a clear, sharp paper that meets your level—high school to Ph.D. |

.3 |

|

Chemicals |

||||

|

Large |

70.5 |

20.2 How Do You Meet My Professor’s Standards?We tailor your paper to your rubric—structure, tone, everything. Our writers decode academic expectations, and editors polish it to perfection, ensuring it’s grade-ready. |

7.6 |

1.6 |

|

Medium and Small |

50.3 What’s Your Editing Process?Upload your draft, tell us your goals, and our editors will refine it—boosting arguments, fixing errors, and keeping your voice. You’ll get a polished paper that’s ready to shine. |

50.5 |

3.8 |

– 4. 7 |

|

Electrical companies: |

||||

|

Large Can You Suggest Paper Topics?Sure! Need ideas? We’ll pitch topics based on your subject and interests—catchy and doable. Pick one, and we’ll run with it, or tweak it together. |

79.4 |

19.4 |

3.1 |

– 1. 9 |

|

Medium and small |

60.4 |

37.4 Do You Offer Rush Revisions?Yes! If you need quick edits, our team can turn it around fast—hours, not days—tightening up your paper for last-minute perfection. |

2.4 |

.1 |

|

Source: Business Monitors (M3) in Mayer (1990) |

Corbett and Jenkinson (1997) provide another evidence to support the Mayer’s findings by analyzing the source of finance of three developed countries including Germany, the US and the UK from 1970-1994. The study shows that in the period 1970-1994, the firms in these countries mostly rely on the internal source of finance with the average proportion of the internal finance and total fixed investment of 78.9 percent in Germany, 93.3 percent in the UK and 96.1 percent in the US. These are stories in developed countries.

What happens in the countries with the state control over financial system? In these countries, state development banks and other state owned banks follow low interest rate policies to stimulate investment (Singh, 1998), especially in the early stage of development. The poof indicates that the most fundamental source of finance for fixed investment comes internal finance; however the share of long-term bank loans were still high compare to the rate in developed countries mentioned above. Choosing Japan before becoming a developed country in 1990’s as the case of state control over financial system, Tsuru (1993) figured out that the share of internal financing over gross manufacturing investment accounted for 60 percent in the late 1950s, increasing to 75 percent in the late 1970’s and around 100 percent in the late 1980’s. The long-term bank loans covered the rest of investment financing, and had continued declining from 1950’s. China is a typical example for the country with the financial system regulated by the government. According to Fisher (2013), the Chinese government plays a central role in the financial system. It is demonstrated by the fact that the proportion of the total assets of state-owned commercial banks and development banks to total banks’ asset accounts for roughly 60 percent. Mlachila and Takebe (2011) argued that due to the government regulation, these banks can lend lower interest rate to firms, especially with state-own enterprises investing in construction, logistic and heavy manufacturing.

Chapter 3: Model specification and hypotheses development

Absolutely! We’ll draft an outline based on your topic so you can approve the plan before we write—keeps everything aligned from the start.

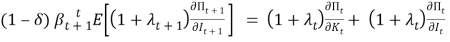

This chapter contains three main parts. The first part presents the theoretical framework to model investment. As mentioned in the previous part, so-called Euler investment equation approach as well as how to use it to test for the presence of financing constraints would be presented here. The second part specifies the model which is expected to test the impact of financial development on firm investment. Hypotheses for the model would be also displayed in the last.

3.1 Modeling investment

3.1.1 Euler equation approach

After the first introduce of Abel (1980), the investment Euler equation approach was widely used by many authors (White, 1992; Hubbard, Krashyap & White, 1995; Bond & Meghir, 1994; Harris, Schiantarelli & Siregar, 1994, Gilchrist & Himmelberg, 1999; Love, 2003; Laeven, 2003; Forbes, 2007, K.S.Chan et al., 2012). The equation is acquired after reorganizing first order conditions when solving the maximizing firm’s value problem.

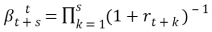

In this paper, the investment model based on Euler equation approach closely follows models in previous studies, especially Laeven (2003) and Bond & Meghir (1994). To construct the model, each firm is assumed to maximize its present value. The firm value is the sum of the expected discounted value of dividends subject to the capital accumulation and external financing constraint. Let  be the firm value at time t,

be the firm value at time t,  the the dividend paid to shareholder at time t, and

the the dividend paid to shareholder at time t, and  the one period discount factor,

the one period discount factor, and

and  Then, the function of firm value at time t is presented in (1) in which E(.) is the expectations operational on time t information. Let

Then, the function of firm value at time t is presented in (1) in which E(.) is the expectations operational on time t information. Let  =

=  denote the profit function taking as the beginning of period capital stock at time t,

denote the profit function taking as the beginning of period capital stock at time t,  ; the vector of variable inputs at time t,

; the vector of variable inputs at time t,  and the firm investment at time t,

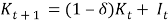

and the firm investment at time t,  . The profit function is assumed to be concave and bounded according to Gilchrist (1999). With the depreciation rate

. The profit function is assumed to be concave and bounded according to Gilchrist (1999). With the depreciation rate  and the investment expenditure at time t,

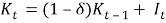

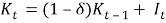

and the investment expenditure at time t,  , the capital stock accumulation follows this formula:

, the capital stock accumulation follows this formula:  . Finally, let

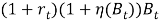

. Finally, let  be the financial liabilities. Under the assumption that the marginal source of external finance is debt and that risk neutral debt holders tend to require an external premium,

be the financial liabilities. Under the assumption that the marginal source of external finance is debt and that risk neutral debt holders tend to require an external premium,  . This premium is expected to be increasing in the amount borrowed to offset the raised costs due to information asymmetry problems. Following Gilchrist (1999) and Laeven (2003), the gross required rate of return on debt is assumed to be equal

. This premium is expected to be increasing in the amount borrowed to offset the raised costs due to information asymmetry problems. Following Gilchrist (1999) and Laeven (2003), the gross required rate of return on debt is assumed to be equal , where

, where  is the risk-free rate of return.

is the risk-free rate of return.

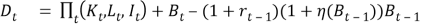

To ensure that the only debt is the firm’s marginal source of finance, a non-negativity constraint on dividends is introduced. It also means that shareholders favor dividends paid out instead of retention. For all of the above, the manager’s problem of maximizing firm’s value is presented as follow:

Subject to:

You bet! Need stats or charts? Our writers can crunch numbers and craft visuals, making your paper both sharp and professional.

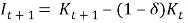

(2)

(2)

(3)

(3)

(4)

(4)

Let λt be the Lagrange multiplier for the non-negativity constraint on dividends in equation (4) to recognize the effect of financial friction. λt is the shadow cost of paying negatives dividends, i.e. issuing new equity. Therefore, in economic meaning, it can be defined as the shadow cost of internally generated funds.

Substituting  in (2) into (1) and using (3) to eliminate

in (2) into (1) and using (3) to eliminate  in the profit function, the Lagrangian function is constructed as:

in the profit function, the Lagrangian function is constructed as:

(5)

(5)

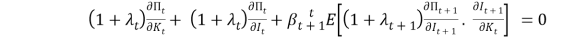

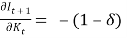

Taking the first order condition for Kt :

(6)

(6)

Because  =>

=>

We break it down—delivering each part on time with consistent quality. From proposals to final drafts, we’re with you all the way.

So,  (7). Substituting (7) into (6):

(7). Substituting (7) into (6):

Rearranging the equation below to obtain the Euler equation:

(8)

(8)

Tags: Academic Writing Help, Ace Tutors, Assignment Help Solutions, Essay Writing Support

You Want The Best Grades and That’s What We Deliver

Our top essay writers are handpicked for their degree qualification, talent and freelance know-how. Each one brings deep expertise in their chosen subjects and a solid track record in academic writing.

We offer the lowest possible pricing for each research paper while still providing the best writers;no compromise on quality. Our costs are fair and reasonable to college students compared to other custom writing services.

You’ll never get a paper from us with plagiarism or that robotic AI feel. We carefully research, write, cite and check every final draft before sending it your way.