Top Essay Writers

Our top essay writers are handpicked for their degree qualification, talent and freelance know-how. Each one brings deep expertise in their chosen subjects and a solid track record in academic writing.

Simply fill out the order form with your paper’s instructions in a few easy steps. This quick process ensures you’ll be matched with an expert writer who

Can meet your papers' specific grading rubric needs. Find the best write my essay assistance for your assignments- Affordable, plagiarism-free, and on time!

Posted: July 15th, 2020

Business cycles synchronization in Latin America: A TVTPMS Approach

Over the last decades, there has been a growing interest in the business cycle transmissions among countries and interdependencies. The design of regional co-operations and integrations, such as Mercosur or Latin America countries, has the purpose to reduce poverty, amplify society welfare and enhance macroeconomic stability. However, it is crucial to understand the influence of regional integration and the role of external factors on regional business cycle synchronization.

We get a lot of “Can you do MLA or APA?”—and yes, we can! Our writers ace every style—APA, MLA, Turabian, you name it. Tell us your preference, and we’ll format it flawlessly.

Fiess (…..) find that a relatively low degree of business cycle synchronization within Central America as well as between Central America and the United States. Grigoli (2009) analyzed the causation relations among business activities of the Mercosur countries to determine which cycles are dependent on others, considering trade intensity, trade structure and the influences of the EU and US as well. He find some causation relations among the South-American countries; however, the EU and US do not play a relevant role in determining the fluctuations of their cycles. Gutierrez and Gomes (…..) use the Beveridge-Nelson-Stock-Watson multivariate trend-cycle decomposition model to estimate a common trend and common cycle. Aiolfi et al. (2010) identify a sizeable common component in the LA countries’ business cycles, suggesting the existence of a regional cycle Caporale and Girardi (2012) show that the LA region as a whole is largely dependent on external developments and the trade channel appears to be the most important source of business cycle co-movement. They report that the business cycle of the individual LA countries appears to be influenced by country-specific, regional and external shocks in a very heterogenous way.

In order to investigate the degree of synchronization of the business cycles among the six major LA economies[1] (namely, Argentina, Brazil, Chile, Mexico, Colombia and Venezuela) as a whole, we consider the presence of a regional cycle by estimating the common growth cycle with the aim of testing its effect on each country-specific cycle.

Besides this introduction, this paper is organized as follows. Section 2 contains the model and describes the data. Section 3 presents the empirical results and finally, section 4 concludes.

We use quarterly data of the real GDP growth rate of the LAC countries, extracted from Penn World Table , namely …………………………, covering the period from the first quarter of …… to the last quarter of …….

Totally! They’re a legit resource for sample papers to guide your work. Use them to learn structure, boost skills, and ace your grades—ethical and within the rules.

We focus on whether the economic activity in the LAC countries is driven by a joint business cycle. We first look at the engine of growth lies within the LA countries. We therefore firstly begin by studying the existence of a common cycle among the economies studied. Second, we attempt to find the influence of a common factor referred to as the LAC’s business cycle extracted from the estimation of a dynamic common factor model.

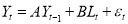

We employ a measure of business cycles synchronization based on Hamilton’s (1989) original Markov-switching model and the time– varying Markov–switching model developed by Filardo (1994) and reconsidered recently by Kim et al. (2008) to investigate the regional common factor in dating the regional business cycles. This study analyzes whether the synchronization pattern of business cycles in a country has systematically changed with the expansion or recession phases of regional business cycle. In this context, we assumed business cycles in a particular country are driven by regional cycles proxied by the common dynamic factor in real GDP growth of the LA countries, thus we use a dynamic factor model to extract the regional cycle. The main interest of the analysis is that a latent dynamic factor drives the co-movement of a high-dimensional vector of time-series variables which is also affected by a vector of mean-zero idiosyncratic disturbances, εt (Stock, 2010). The common factors are assumed to follow a first-order autoregressive process. This linear state-space model can be written as follows:

(1)

(1)

Starts at $10/page for undergrad, up to $21 for pro-level. Deadlines (3 hours to 14 days) and add-ons like VIP support adjust the cost. Discounts kick in at $500+—save more with big orders!

(2)

(2)

where L1,t,…,Lk,t are common to all the series, ε and η are independent Gaussian white noise terms. The L matrix of factor loadings measures the instantaneous impact of the common factors on each series.

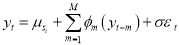

There are two growth phases or regimes with a transition between them governed by a time-varying transition probability matrix. The advantage of such a model is that the regimes can be easily interpreted as regimes of recession and expansion. The estimated equation is the following[2]:

,

,  (3)

(3)

100%! We encrypt everything—your details stay secret. Papers are custom, original, and yours alone, so no one will ever know you used us.

where and

and

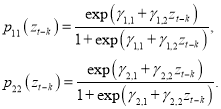

The endogenous variable, yt (the real growth rate in a given country at time t) is assumed to visit the two states of a hidden variable, st, that follows a first-order Markov chain, over the T observations[3]. μst, σ, Ï• are real coefficients to be estimated. Denoting zt the leading variable (the regional common factor at time t), we want to know whether zt causes yt+k, k= 1,2, ….Under the assumption that both y and z have ergodic distributions, we define the following transition probability functions:

(4)

(4)

where and

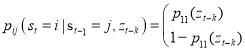

and  are elements of the following transition probability matrix:

are elements of the following transition probability matrix:

Nope—all human, all the time. Our writers are pros with real degrees, crafting unique papers with expertise AI can’t replicate, checked for originality.

(5)

(5)

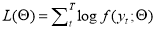

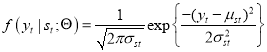

with Pij the probability of switching from regime j at time t − 1 to regime i at time t and i, j =1, 2 with  for all i,j∈{1,2. k is a lag. In order to estimate the coefficients of equation (1), we need to maximize the log-likelihood of the unconditional density function of yt:

for all i,j∈{1,2. k is a lag. In order to estimate the coefficients of equation (1), we need to maximize the log-likelihood of the unconditional density function of yt:

(6)

(6)

The unconditional density function is the product of the conditional density function and the unconditional probability of st. This is written as[4]:

(7)

(7)

Transition probabilities indicate that the states of expansion and recession are equally persistent, and this persistency is very strong. These probabilities aim to provide information about the likelihood of staying or switching from a given regime of k periods after a regime change in z. If the estimate of μ1 is positive and μ2 is negative, then regime 1 can be interpreted as one of expansion and regime 2 as one of contraction. Furthermore, assume that in eq. (…) γ1,2 is positive. This indicates that while any increase in leading indicator (z) increases P11, probability that y stays in regime 1, any decrease in z increases 1-P11, probability that y switches from regime 1 k periods later; that is, an expansion (recession) in z leads to an expansion (recession) in another country. Similarly, a negative γ1,2 means that an expansion in z leads to a recession in another country. Additionally, a negative γ2,2 means that any decrease (increase) in leading indicator increases the probability of staying in regime 2 (switching from regime 2). If both γ1,2 and γ2,2 are insignificant, this would mean that there is no statistically meaningful impact of the occurrence of expansions or recessions in a leading market on the growth regime of the other markets[5].

Fig. 1 refers to the common factor, i.e. the regional growth cycle of the Latin America countries. As we can see, the common factor easily captures the well-known common features of the LA business cycle such as the 1994–95 Mexican crisis and the Tequila crisis. To test the hypothesis of a joint business cycle in the LA, we estimate the TVTPMS model given by Eqs. (1) and (2) with the variable z referring to the common factor (regional cycle).

Experts with degrees—many rocking Master’s or higher—who’ve crushed our rigorous tests in their fields and academic writing. They’re student-savvy pros, ready to nail your essay with precision, blending teamwork with you to match your vision perfectly. Whether it’s a tricky topic or a tight deadline, they’ve got the skills to make it shine.

Fig. 1. Common factor in real GDP growth of the Latin America countries

The estimation results for the regional cycle as leading variable are reported in Table 1. We find significantly positive μ1 and negative μ2 which correspond to a situation of distinct expansion and contraction regimes. Our main findings are based on the significance of the estimated coefficients γ1,2 and γ2,2. When looking at the significance of the coefficient γ1,2 , it is found that the common factor exerts direct effects on Mexico and Venezuela, implying that a high growth rate in regional cycle is informative of GDP expansion phases in these countries. That is, an expansion in common factor increases the probability that Mexico and Venezuela will continue to evolve in an expansion regime (i.e. P11). However, we see that γ2,2 is never significant for these countries. This suggests that the regional cycle can never be considered as a leading indicator of the future state of the cycle in Mexico and Venezuela when they are already in the contraction regime (i.e. P22 and P1-22). Conversely, our results show that regional cycle is sensitive to economic fluctuations in Colombia, Chile and Brazil because γ2,2 is significant, thereby implying that any change in regional factor does help predict whether these economies will stay into or escape from contractions.

Table 1

Guaranteed—100%! We write every piece from scratch—no AI, no copying—just fresh, well-researched work with proper citations, crafted by real experts. You can grab a plagiarism report to see it’s 95%+ original, giving you total peace of mind it’s one-of-a-kind and ready to impress.

Estimation results for the regional cycle as leading variable. The numbers in bold indicate that a high growth rate in Mexico, Venezuela, Colombia, Chile, and the Brail has an impact on the expansion and recession phases of the regional cycle.

|

y |

Mexico |

Venezuela Can You Use Any Citation Format?Yep—APA, Chicago, Harvard, MLA, Turabian, you name it! Our writers customize every detail to fit your assignment’s needs, ensuring it meets academic standards down to the last footnote or bibliography entry. They’re pros at making your paper look sharp and compliant, no matter the style guide. |

Colombia |

Argentina |

Chile |

Brazil Can I Change My Order Details?For sure—you’re not locked in! Chat with your writer anytime through our handy system to update instructions, tweak the focus, or toss in new specifics, and they’ll adjust on the fly, even if they’re mid-draft. It’s all about keeping your paper exactly how you want it, hassle-free. |

|

Lag k |

t ̶ 0 |

t ̶ 0 |

t ̶ 1 How Do I Order a Paper?It’s a breeze—submit your order online with a few clicks, then track progress with drafts as your writer brings it to life. Once it’s ready, download it from your account, review it, and release payment only when you’re totally satisfied—easy, affordable help whenever you need it. Plus, you can reach out to support 24/7 if you’ve got questions along the way! |

t ̶ 1 |

t ̶ 1 |

t ̶ 1 |

|

μ1 How Quick Can You Write?Need it fast? We can whip up a top-quality paper in 24 hours—fully researched and polished, no corners cut. Just pick your deadline when you order, and we’ll hustle to make it happen, even for those nail-biting, last-minute turnarounds you didn’t see coming. |

0.007*** (7.69) |

0.008*** (2.63) |

0.009*** Can You Handle Tough Topics?Absolutely—bring it on! Our writers, many with advanced degrees like Master’s or PhDs, thrive on challenges and dive deep into any subject, from obscure history to cutting-edge science. They’ll craft a standout paper with thorough research and clear writing, tailored to wow your professor. (7.37) |

0.013*** (3.36) |

0.007*** (4.16) How Do You Match Professor Expectations?We follow your rubric to a T—structure, evidence, tone. Editors refine it, ensuring it’s polished and ready to impress your prof. |

0.007*** (5.47) |

|

μ2 |

-0.023*** How Do You Edit My Work?Send us your draft and goals—our editors enhance clarity, fix errors, and keep your style. You’ll get a pro-level paper fast. (-3.67) |

-0.014*** (-4.57) |

-0.015*** (-2.96) Can You Brainstorm Topics?Yep! We’ll suggest ideas tailored to your field—engaging and manageable. Pick one, and we’ll build it into a killer paper. |

-0.013*** (-3.71) |

-0.055*** (-4.25) |

-0.034*** (-7.09) |

|

Ï• Do You Offer Fast Edits?Yes! Need a quick fix? Our editors can polish your paper in hours—perfect for tight deadlines and top grades. |

0.306*** (4.29) |

-0.09 (-0.34) |

0.078 (0.71) Can You Start With an Outline?Sure! We’ll sketch an outline for your approval first, ensuring the paper’s direction is spot-on before we write. |

0.19 (1.16) |

0.36*** (3.74) |

0.402*** (3.99) |

|

σ |

-4.73*** Can You Add Charts or Stats?Definitely! Our writers can include data analysis or visuals—charts, graphs—making your paper sharp and evidence-rich. (-48.09) |

-3.78*** (-19.46) |

-4.909*** (-68.87) |

-4.23*** (-40.24) |

-4.13*** (-49.83) |

-4.53*** What About Multi-Part Projects?We’ve got it—each section delivered on time, cohesive and high-quality. We’ll manage the whole journey for you. (-37.49) |

|

γ1,1 |

1.78** (2.48) |

5.44*** Do You Adapt to International Rules?Yes! UK, US, or Aussie standards—we’ll tailor your paper to fit your school’s norms perfectly. (5.28) |

7.06*** (3.33) |

-2.49*** (-4.73) What does a complex assignment mean?If your assignment needs a writer with some niche know-how, we call it complex. For these, we tap into our pool of narrow-field specialists, who charge a bit more than our standard writers. That means we might add up to 20% to your original order price. Subjects like finance, architecture, engineering, IT, chemistry, physics, and a few others fall into this bucket—you’ll see a little note about it under the discipline field when you’re filling out the form. If you pick “Other” as your discipline, our support team will take a look too. If they think it’s tricky, that same 20% bump might apply. We’ll keep you in the loop either way! |

3.74*** (4.14) |

2.707*** (5.11) Who is my writer? How can I communicate with him/her?Our writers come from all corners of the globe, and we’re picky about who we bring on board. They’ve passed tough tests in English and their subject areas, and we’ve checked their IDs to confirm they’ve got a master’s or PhD. Plus, we run training sessions on formatting and academic writing to keep their skills sharp. You’ll get to chat with your writer through a handy messenger on your personal order page. We’ll shoot you an email when new messages pop up, but it’s a good idea to swing by your page now and then so you don’t miss anything important from them. |

|

γ1,2 |

0.59** (2.29) |

0.14** (2.204) |

-0.76 (-1.63) |

0.14 (0.58) |

0.008 (0.029) |

0.174 (1.06) |

|

γ2,1 |

3.47 (1.56) |

49.56 (1.55) |

-4.76** (-2.46) |

3.13** (2.14) |

-1.51 (-1.29) |

18.007*** (4.29) |

|

γ2,2 |

-1.16 (-1.18) |

-39.67 (-1.37) |

-2.28*** (-3.08) |

-1.09 (-1.405) |

-2.09*** (-2.69) |

-0.965*** (-6.801) |

|

Log L |

539.7175 |

401.0214 |

594.7450 |

451.2714 |

449.2510 |

508.6780 |

The evidence presented here indicates that Latin America countries’ increasing economic interdependence has strengthened both interregional business cycles synchronization. A regional cycle could provide significant informational content in predicting the future state of Mexico and Venezuela only when they are already into the expansionary state and the future state of Colombia, Chile and Mexico when they are already in the contraction regime. That is, the high level of integration reached within the region has enabled Mexico and Venezuela to emerge as a pole of economic growth where their business cycles are mutually reinforced during expansions. In other words, while this increasing economic interdependence tends to strengthen output co-movements when these countries are already in the expansionary state, the shift from contractions to recovery, opposed to Colombia, Chile and Mexico, do not depend on the recovery in other countries. For Argentina, both γ1,2 and γ2,2 is insignificant, implying any change in the regional cycle regional cycle is not sensitive to economic fluctuations in this country.

The paper’s other main finding is that a regional cycle could provide significant informational content in predicting the future state of the five of the largest Latin American economies—Argentina, Brazil, Venezuela, Chile, and Mexico. However, the amplitude and duration of the business cycle are asymmetric, indicating that nonlinearities are important in the growth process.

Thus, since the Latin America countries’ business cycles are well-tied together through a regional cycle, the costs of joining a monetary union would be reduced if a deeper regional economic cooperation, including intra-exchange rate stability and macroeconomic policy coordination, before turning on to a full-fledged monetary union. Since the Latin American economies have historically been highly dependent globalization process and demand from outside trading partners it would be interesting repeating a similar exercise with interest rates and cyclical output in advanced countries.

References

Hamilton, J.D., 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57, 357–384.

Filardo, A.J., 1994. Business cycle phases and their transitional dynamics. J. Bus. Econ. Stat. 12, 299–308.

[1] These countries have accounted for some 70 percent of the region’s GDP over the past half century (Maddison, 2003, pp. 134–140)

[2] The lag structure has been tested with standard AIC, HQ and SC criteria.

[3] The occurrence of a regime is referred by a variable st that takes two values: 1 if the observed regime is 1 and 2 if it is regime 2

[4] The lags in the model are chosen using the Akaike information criterion. Moreover, we perform the Ljung–Box (LB) test to check that there is no residual autocorrelation

[5] In this case, The TVPMS model converges to the Hamilton fixed probability model

Tags: #1 Dissertation Writing and Essay Services, Best Assignment Help for Academic Papers, Cheap Essay Writing with Online Tutoring, Dissertation Writing and Write My Essay SolutionsYou Want The Best Grades and That’s What We Deliver

Our top essay writers are handpicked for their degree qualification, talent and freelance know-how. Each one brings deep expertise in their chosen subjects and a solid track record in academic writing.

We offer the lowest possible pricing for each research paper while still providing the best writers;no compromise on quality. Our costs are fair and reasonable to college students compared to other custom writing services.

You’ll never get a paper from us with plagiarism or that robotic AI feel. We carefully research, write, cite and check every final draft before sending it your way.